What do you want to Enquire about?

About Us

We are independent Insurance, Investment & Risk Management Advisory, We are in this field since 50 years and with this experience we take consultative approach to insurance. We believe insurance is not a commodity and needs to be respected. We are committed to selling you only what you need, and we have years of experience in finding coverage gaps and other potential pitfalls. We also offer claim management through the perfectly developed claim settlement system which is tested and perfected over decades of experience. We provide everything you expect from an insurance adviser Knowledge, Professionalism, Industrial Influence plus capability to handle complex insurance and claims. Everything we do is to offer a better and most reliable insurance purchasing experience to our customers.

View more

Our Leadership Team

Mr. Manish Busa

Business Head

Products & Services

Fire Insurance

Product Detail

Fire Insurance

We are providing Fire Insurance

+ Show more

- Show less

Marine Insurance

Product Detail

Marine Insurance

We are providing Marine Insurance

+ Show more

- Show less

Travel Insurance

Product Detail

Travel Insurance

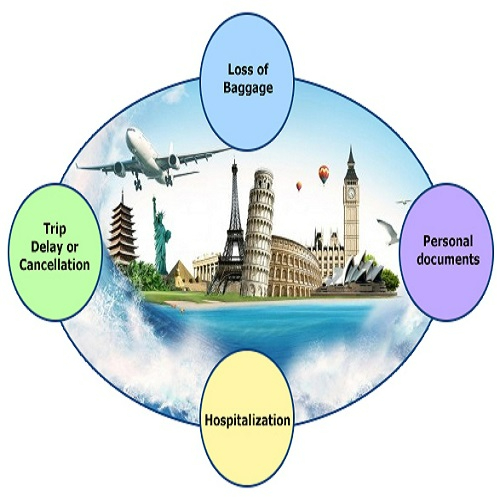

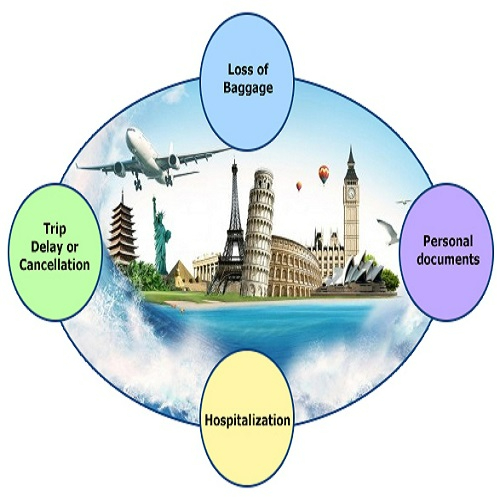

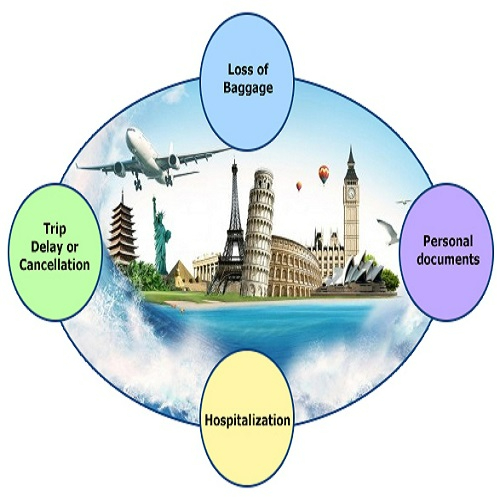

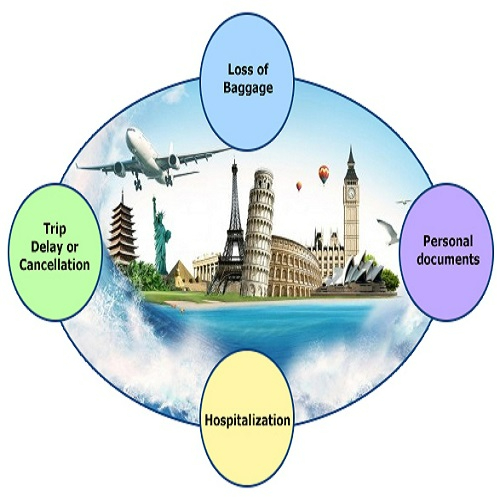

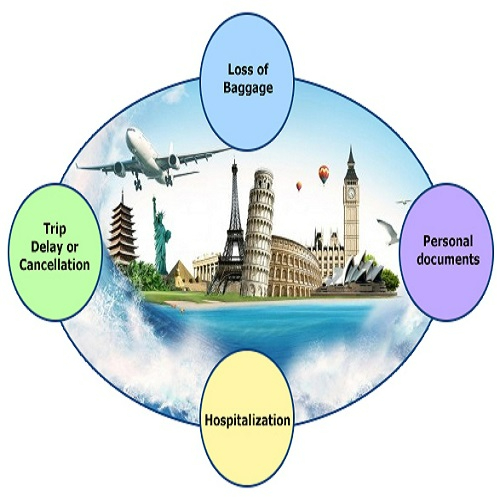

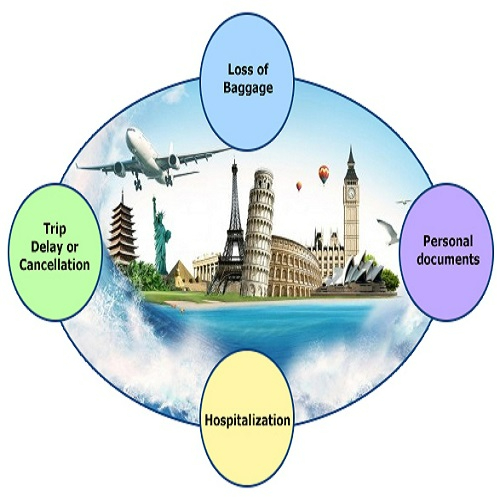

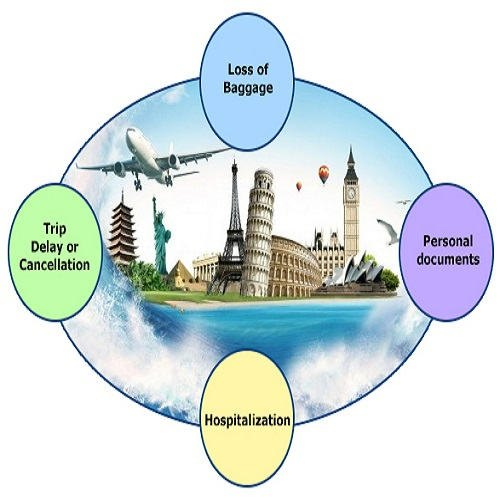

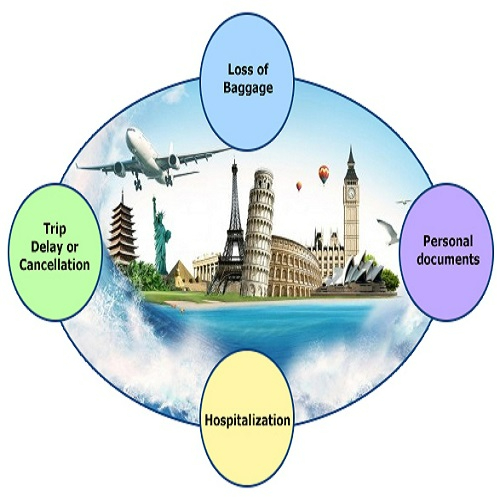

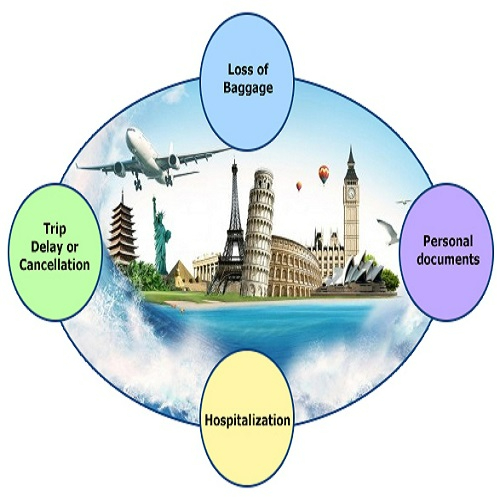

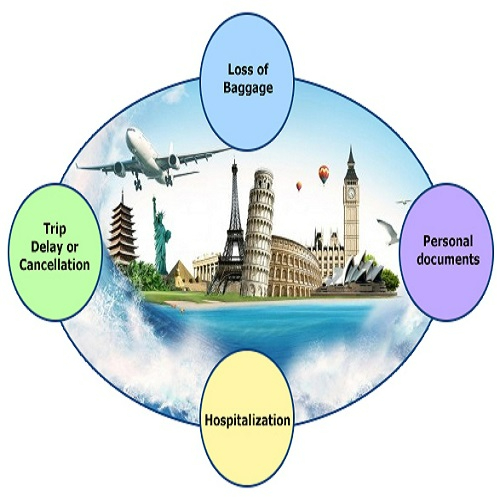

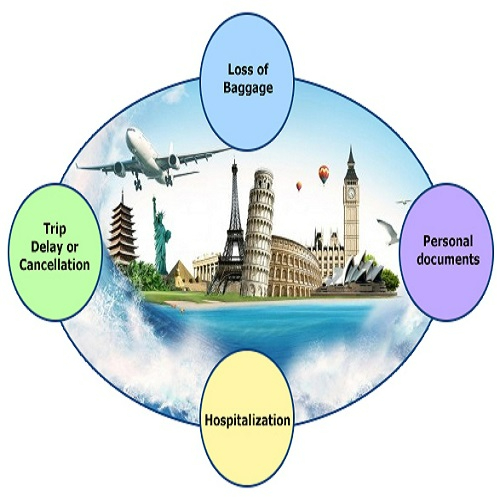

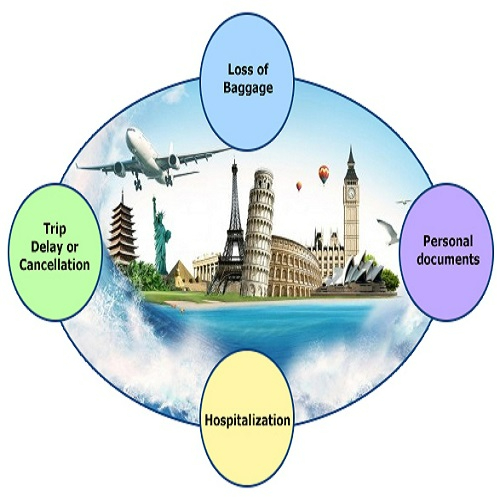

Traveling has become an integral part of our modern society. We could be traveling for reasons like a business trip or much awaited vacation. But one cannot deny the fact that there are several things that could go wrong when one travels. Disruptions like cancellation of flights, loss of baggage, medical emergency- are some of the unforeseen events that could catch you off guard. So whether you are off to your favorite destination for a holiday or going on a business trip - an adequate & complete travel insurance is a must have.

+ Show more

- Show less

Life Insurance

Product Detail

.png)

Life Insurance

Founded in 1956, Life Insurance Corporation of India (LIC) is the largest life insurance company in the country with a total income of Rs. 6,15,882.94 crore and total assets worth Rs. 31,96,214.81 crore It’s fully owned by the Government of India & is also the county’s largest investor.

+ Show more

- Show less

Mutual Funds

Product Detail

Mutual Funds

Mutual Funds are of following types:

- Top Performing Funds

- Dividend Declared

- New Funds Offer

- Search Funds

+ Show more

- Show less

General Insurance

Product Detail

General Insurance

In today’s fast paced lives that we live and in a race to excel in everything, we forget one of the most important asset we own i.e. our health. Due to various habits & changing lifestyles, health related concerns have just become increasingly alarming. We may not be to go back to slow down the pace of our lives but can definitely guard ourselves from its side effect. Here’s when an efficient health cover comes handy so that any sudden illness doesn’t derail our financial freedom.

Medical assistance comes with a price tag, such that people are forced to sell of their assets or rely on borrowers to meet the expenses. Such unforeseen events can be easily dealt with a strong health insurance plans. So guard your finances by opting for complete protection for you & your family by getting adequate health cover as per your requirements.

+ Show more

- Show less

Personal Accident Insurance

Product Detail

Personal Accident Insurance

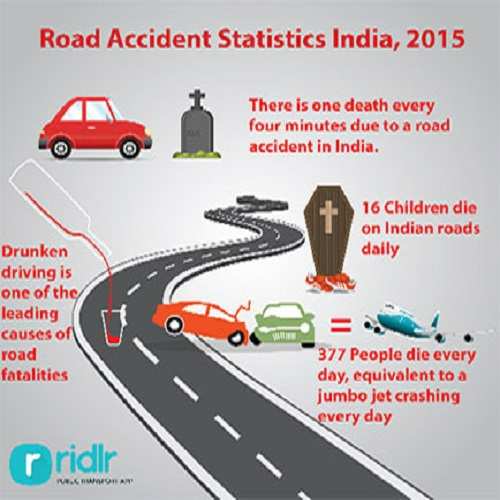

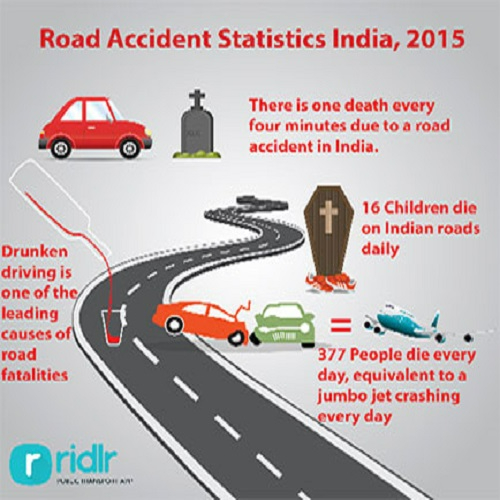

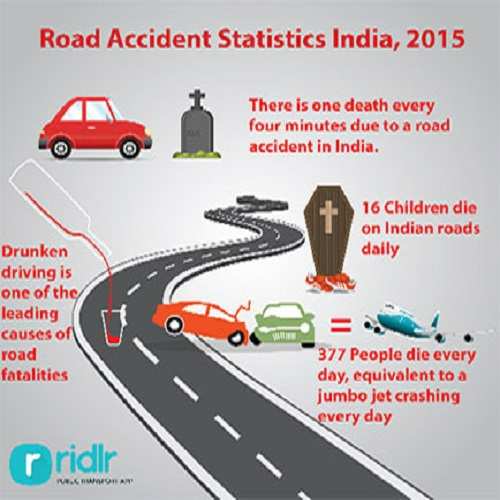

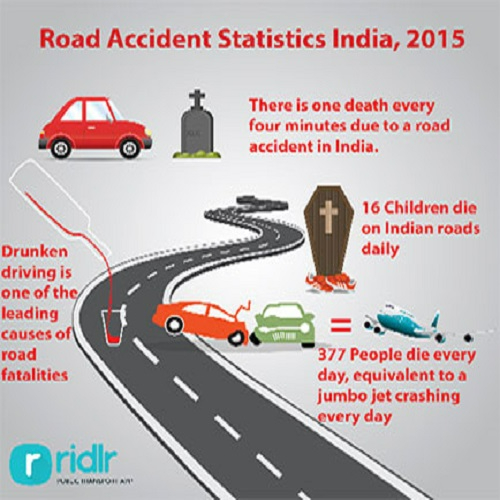

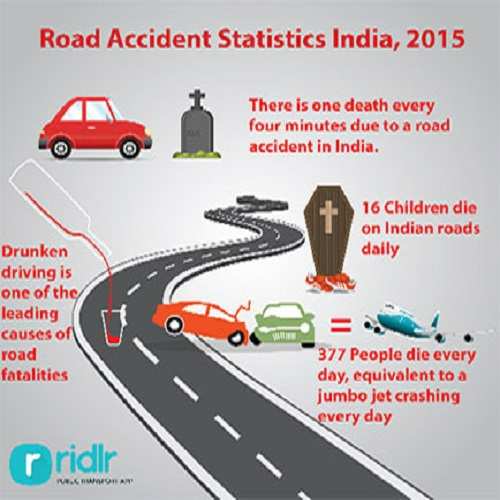

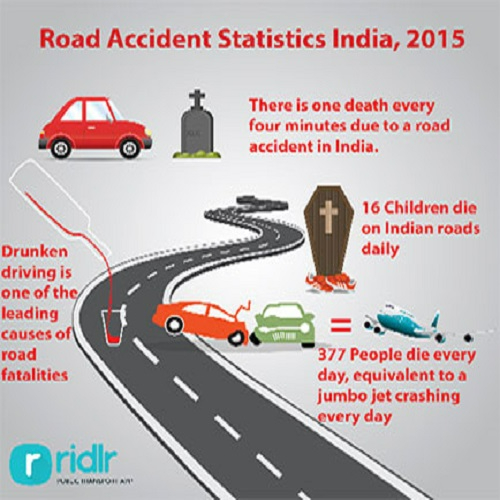

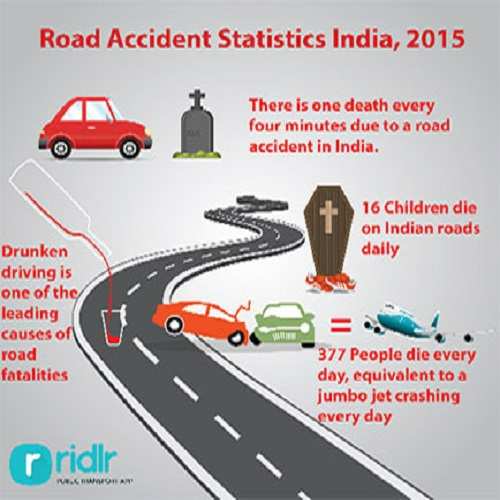

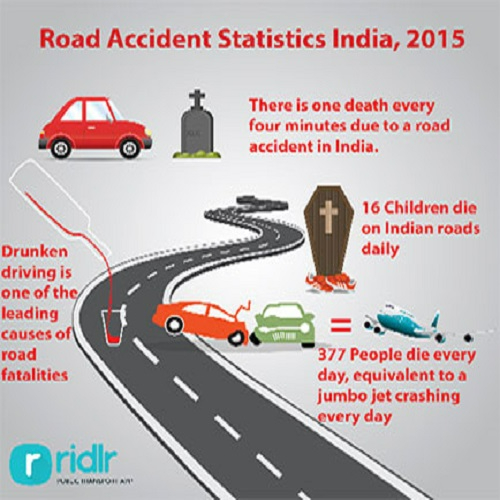

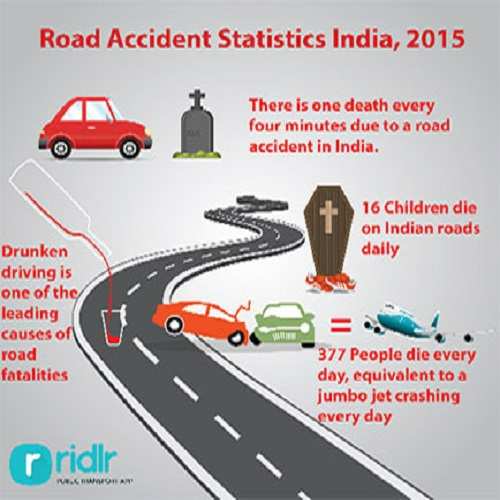

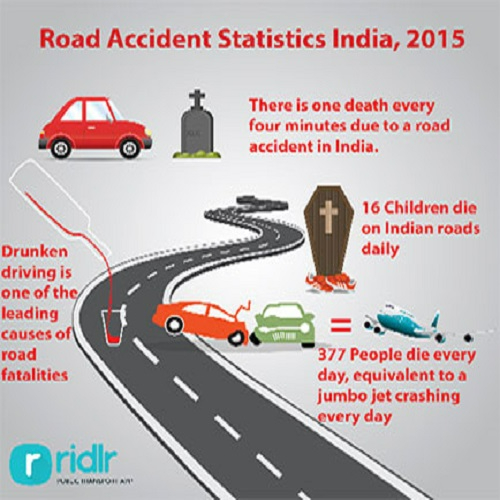

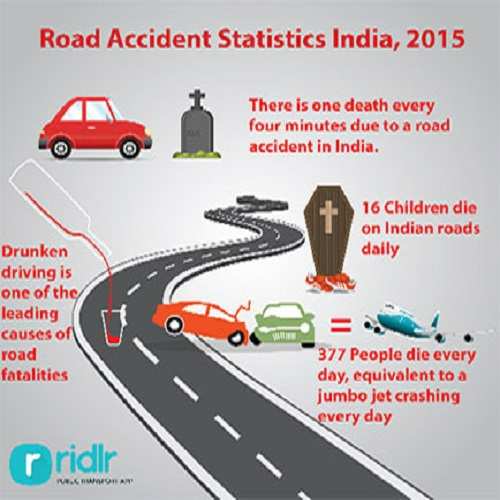

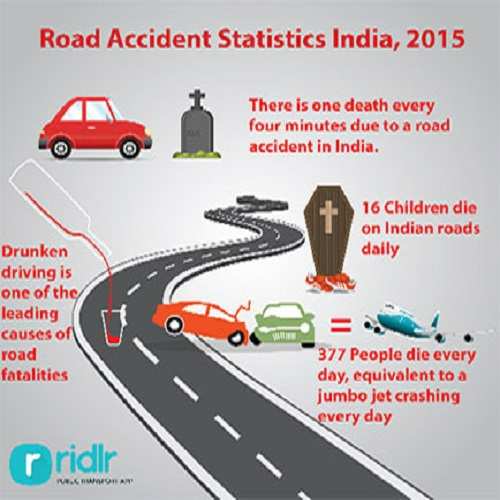

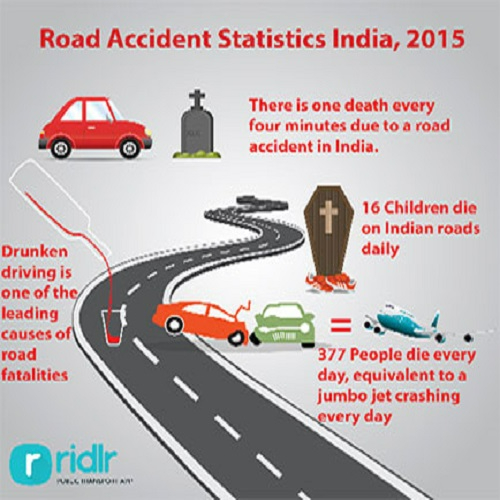

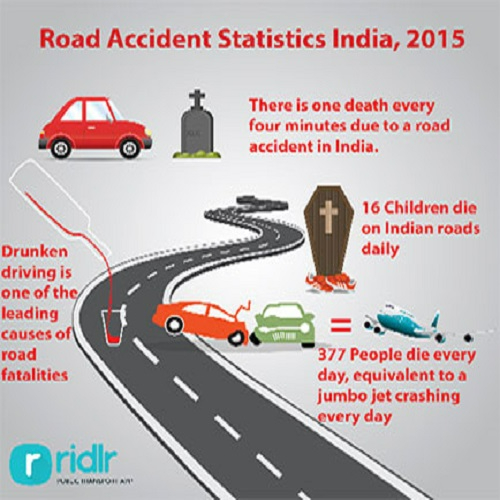

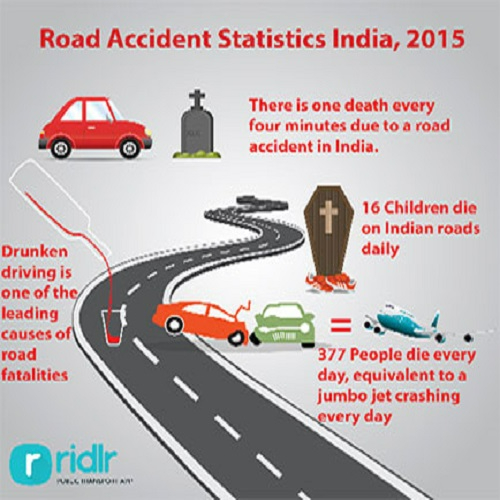

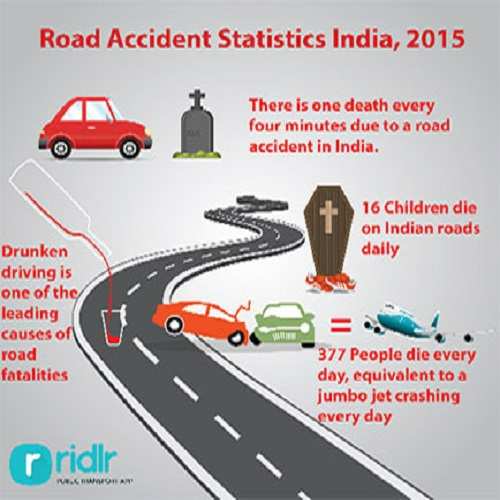

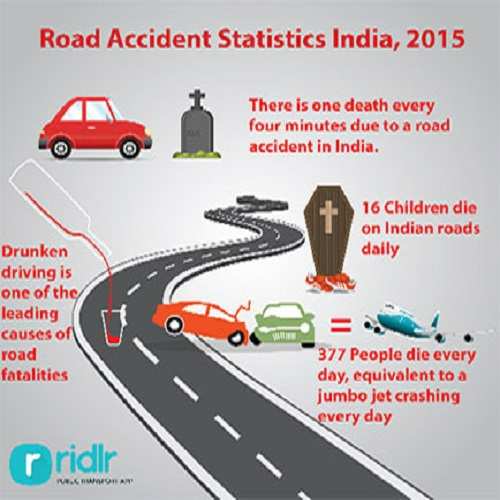

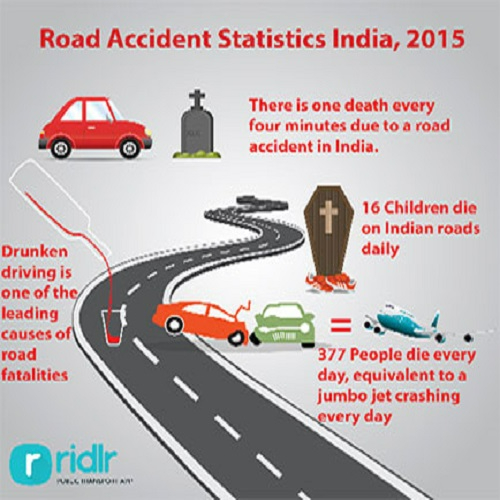

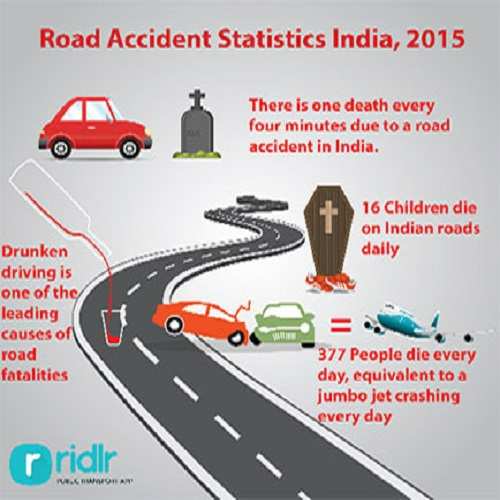

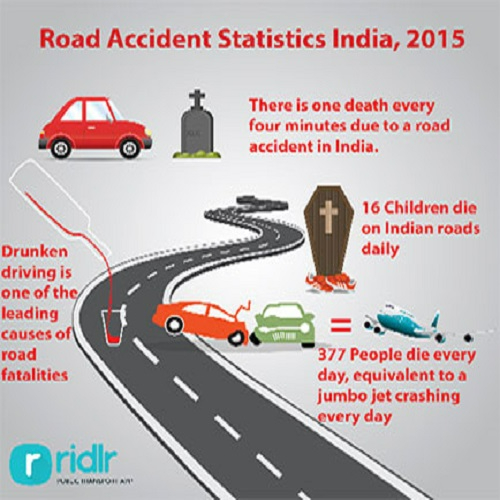

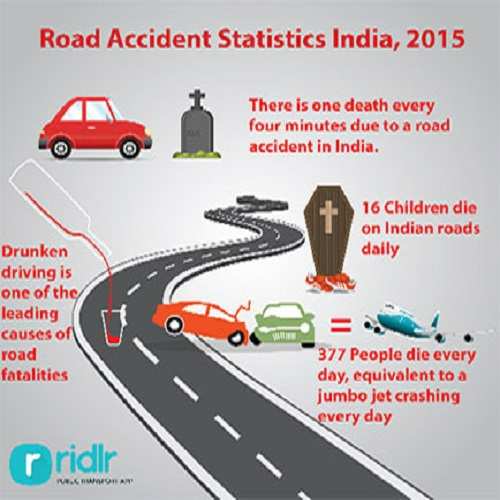

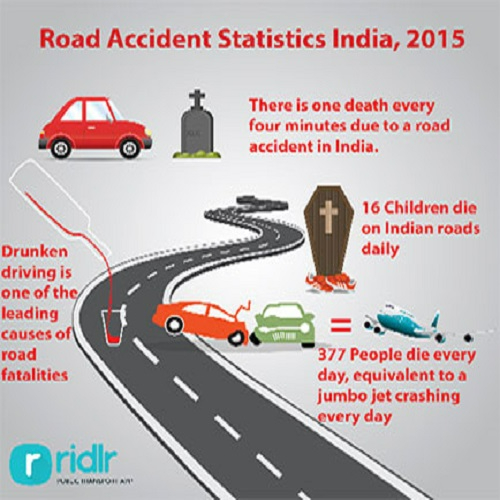

Life is uncertain & immeasurable. Accidents & uneventful incidents never ring a warning bell before they strike. Road mishaps, accidents have gone up tremendously & the victims along with their families suffer the consequences of the such unfortunate situation. Alarming statistics report about 1214 road related death that occur in India every year; this should be an eye opener on the perils an individual is exposed daily.

While minor accidents can cause temporary hurdles, major ones can lead to disability for life or even demise. With a view to providing certain relief, insurance companies have devised various policies that serve as true life savers when met with an unfortunate circumstance.

+ Show more

- Show less

Motor Insurance

Product Detail

Motor Insurance

Auto insurance policy is mandatory for vehicle owners as per Indian Motor Vehicles Act 1988. This Plan is designed to give coverage for losses which insured might incur in case his gets stolen or damaged. The amount of Auto insurance premium is decided based on the Insured Declared Value of a car. The premium will increase, if you raise the IDV limit and vice versa.

Auto insurance is mandatory for all vehicles that ply on roads-like car, trucks, etc. The prime objective of this type of insurance is to provide complete protection & coverage on physical damage or loss from man-made & natural disasters. According to Indian Motor Act 1988, an auto insurance policy is mandatory for every automobile owner in the country. Hence, purchasing an auto insurance is not just a necessity, it is mandatory by law.

+ Show more

- Show less

FD and Bonds

Product Detail

FD and Bonds

A fixed deposit or term deposits is an saving option offered by banks wherein a depositor can invest their money for a fixed tenure & rate. The rate of interests depends on the duration of the deposits & the banks.

Non-Convertible Debentures or NCD cannot be converted into equity shares & hence offer investors higher interest rates. NCDS can further be classified as Secured & Un-Secured. Secured NCDs are backed by the organization or the issuer company’s assets to fulfill debt obligation. Moreover, NCDs may also feature Put Or Call Options. In simple terms, if the NCDs are issued under “Call Options” (Callable Bonds) then they can be redeemed by the issuer before the maturity. The issuer can can call back bonds if they are issued in a high rate environment & the rates fall subsequently. Whereas in a bond issued under “Put Option” , the investor can sell the bond to the issuer at a specified price before its maturity, if the interest rates go up after the issuance of the bonds.

+ Show more

- Show less

Small Savings

Product Detail

Small Savings

Small Savings schemes are designed to provide safe and attractive investment options to the public and at the same time mobilise resources for development. These schemes are operated through 1.54 lakh post offices in the country. Public Provident Fund Scheme is also operated from 8000 branches of public sector banks in addition to the post offices. Deposit Schemes for retiring employees are operated through selected branches of public sector banks only.

+ Show more

- Show less

View more